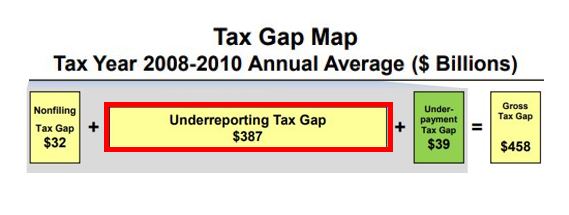

American taxpayers get a “B-” grade for tax compliance – that is, according to the 10-point grading scale, taxpayers are 81.7% compliant. What does that mean? The US Treasury loses over $458 billion a year to non-compliance. And this measurement is for the 2008-2010 tax years.

A lot has changed since 2010 – and the IRS is getting ready to release its new tax gap study this summer to show us new tax compliance figures. The biggest problem facing the IRS for years is the amount of tax dollars lost to taxpayer who file incorrect tax returns. Incorrect tax returns -or the “underreporting tax gap”- makes up over 85% of the tax gap – that’s $387 billion dollars a year in 2010 tax year dollars.

How does the IRS combat underreporting? Largely through audits and matching notices. However, lately the IRS’ ability to fight the underreporting tax gap is diminishing fast.

The IRS recently released its statistics for 2018. The ability to close the tax gap is shrinking each year as the IRS loses its ability to fight non-compliance. Here are some data trends:

#1: The big problem is incorrect tax returns

There are three areas of the tax gap- non-filing, underpayment, and underreporting. Underreporting is by far the worst problem for the IRS – it represents 85% of the tax gap. In 2010 dollars, that measures over $387 billion of the total $458 billion lost each year due to noncompliance. The IRS #1 tax gap strategy is to close the underreporting tax gap. How do you close this gap? Audits and underreporter notices.

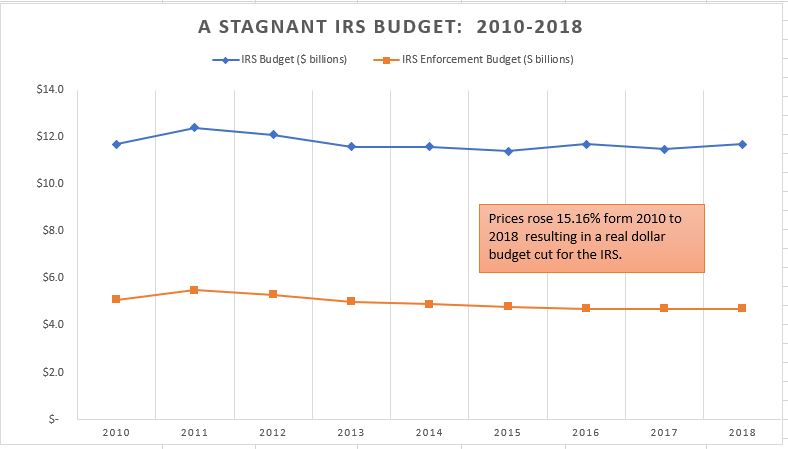

#2: Adjusted for inflation, the IRS budget has dropped.

If you account for inflation, the IRS budget should have increased 15.16% from 2010 to 2018. However, the budget for 2018 is the same as it was in 2010 – $11.7 billion. And funding for IRS enforcement dollars (i.e. audits and collection) have dropped by $400 million from 2010 to 2018. In short, as many have pointed out, the IRS has much less resources to close the tax gap.

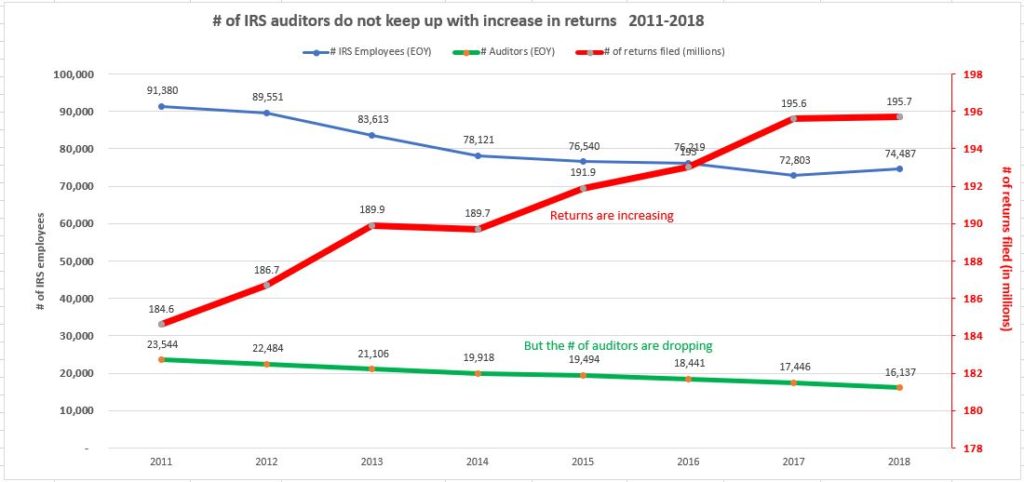

#3: Returns filed have increased by 6%, but the # of auditors have dropped by 31%.

From 2011 to 2018, taxpayers have filed more returns that are subject to audit and scrutiny, However, the number of IRS auditors has gone in the other direction. During this time period, the IRS lost 31% of its auditors (revenue agents and tax examiners) who conduct office and field examinations.

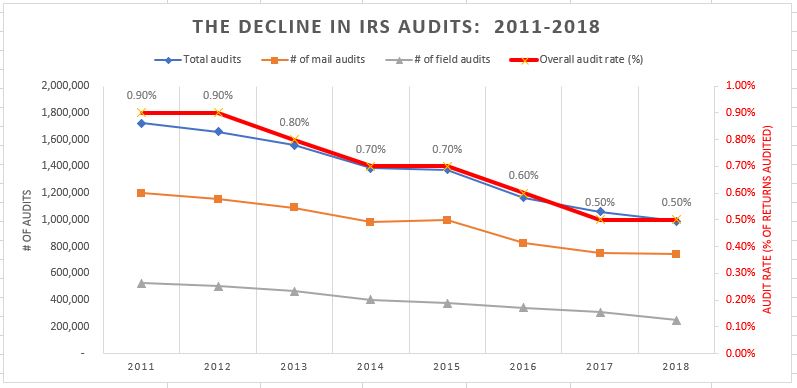

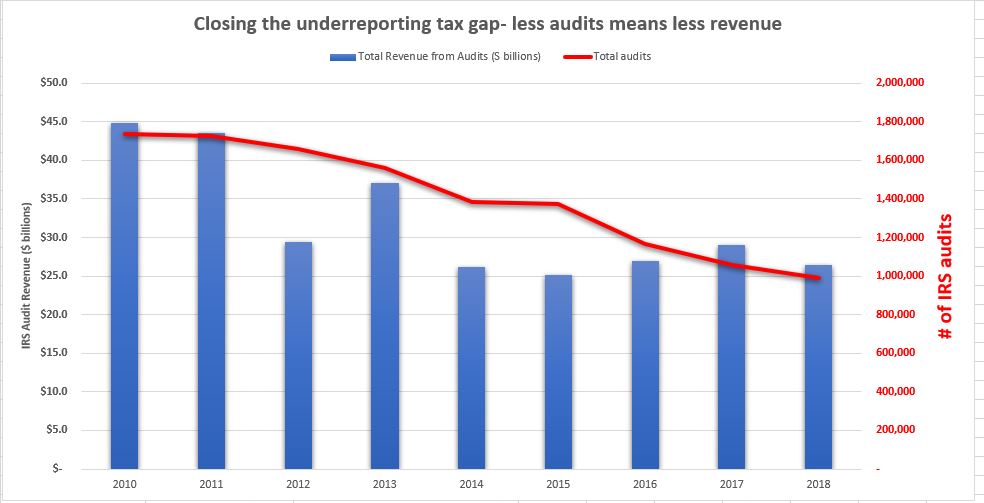

#4: Less auditors, less audits

The natural progression: less auditors means less audits. The number of audits have plunged 42% since 2010 – from a high of 1.735 million audits in 2010 to less than 1 million in 2018. And the audit is now 0.5% – the lowest since IRS reforms in the late 1990s.

#5: The IRS is losing ground – and the tax gap is increasing

Back in 2010, the IRS closed the tax gap by assessing over $45 billion from audits. In 2018, the IRS assessed $26.5 billion from its audits – a 41% drop in audit production.

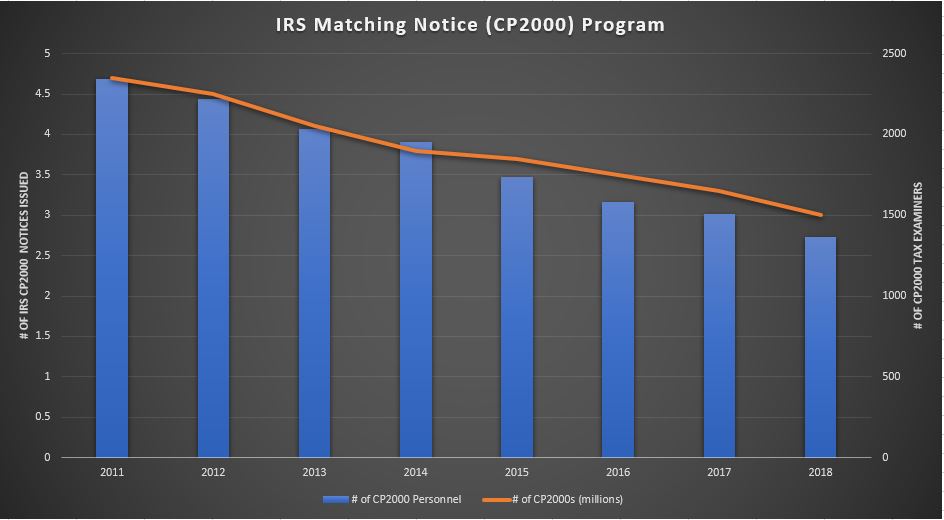

#6: The IRS is even losing the ability to send matching notices

IRS matching programs are fairly automated and cost much less than audits. Each year, the IRS can match tax returns with the billions of Forms W-2/1099 and other information statements sent to the IRS. Last year, they were able to send only 3 million mismatch notices (called “CP2000” notices). This is alarming considering that each year about 28 million taxpayers have a discrepancy and do not accurately report income and deductions reported on information statements. This cornerstone, high-volume program is not an audit- but to taxpayers it looks exactly like a mail audit. The reason for the drop: the number of CP2000 tax examiners has dropped by 32% since 2011.

In 2011, the IRS was able to send over 4.7 million CP2000 matching notices. In 2018, the number of CP2000s have dropped 36% – to only 3 million notices to taxpayers. The effect is not great in terms of additional assessments forgone, but the compliance effect for the IRS of not pointing out erroneous returns can have a long-term impact on voluntary compliance.

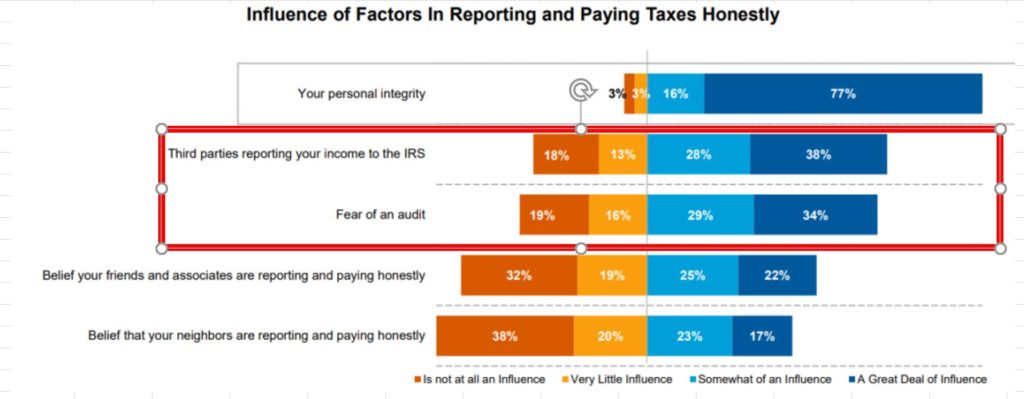

#7: Audits and matching notices are clear compliance drivers

This data point is why many tax administrators and lawmakers are concerned about the IRS audit rate. Fear of an audit and third-party information reporting to the IRS are key drivers to voluntary compliance. Not sending notices to discrepant taxpayers is not reinforcing that underreporting has consequences. This trend could have long-term consequences to the US Treasury.

Solutions?

There is some hope that the IRS budget will see some increases in the future. But building the IRS audit capacity to its former levels will take years. Also, relying on expensive IRS audits may not be a good long-term solution for the IRS to battle noncompliance. Many believe that this is a tipping point for the IRS and tax administration.

However, many of the proposed solutions may be more daunting than adding resources to the IRS. Many have proposed solutions aimed at getting to the root of the problem: tax preparation. The strategic problem is that the current tax system cannot police the accuracy of the returns at the time of filing. The result is a “look-back compliance” enforcement system that requires the IRS to audit and send matching notices where they suspect errors. To increase the accuracy of more tax returns, the IRS only solution is to increase its ability to “look-back” – that is, add more auditors.

Others have proposed several solutions to enable taxpayers and tax preparers to file more accurate returns. These solutions may seem radical to many who have a traditional view of how taxes are prepared and filed each year.

One solution is the “real-time” tax system in which taxpayers have visibility to their information statements before they file. The formula: increased visibility to your information and a head start on your return equals more compliance. Congress regularly takes up the issue of pre-filling tax returns with Forms W-2/1099 and prior tax profiles. The IRS does not have line-of-sight on this solution as it would require some legislative changes and IRS technology would have to greatly increase before pre-filled returns are a reality. A better answer to developing a real time tax system may lie in a government-tax industry partnership. The tax industry and tax software companies likely have a better edge to innovate to pre-filled returns long before the IRS develops this capability.

However, we all know taxes are more complex – and pre-filling is not the answer for the more complicated returns. To that end, the IRS knows that more complicated returns are done by professionals. Both taxpayers and the IRS agree that tax preparers should be regulated to increase the accuracy of filed returns. The formula here: increase the ability to control the preparer and you will increase the accuracy of the returns filed. This seems like a no-brainer but it still relies on IRS investigators to check up on preparers. That requires resources.

There are many other solutions that have been proposed. But what is clearly not on the radar for the near future is more audits- and that means the tax gap will grow wider than ever.

Taxpayers and lawmakers are in for another sobering checkpoint when the new tax gap statistics are released this summer. It is likely that the tax gap has grown to over a half-trillion dollars a year lost due to noncompliance. At that point, maybe some of the old solutions and new innovations will be pursued to provide a long-term strategic answer to fighting noncompliance in our tax system.