The tax code has over 150 penalties that apply to late filing, late payment, filing an inaccurate return, or other non-compliant behavior. In 2018, the IRS assessed almost 39 million penalties to 27 million taxpayers.

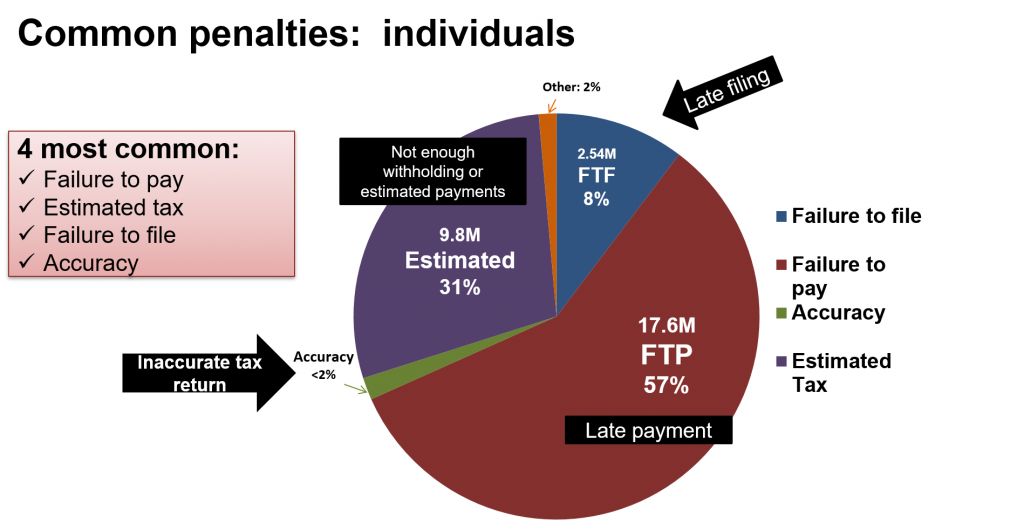

For individual taxpayers, the four most common penaltiesmake up 98% of all penalties assessed:

- Failure to pay penalties: 57% of all penalties assessed

- Estimated tax penalty: 31% of all penaltiesassessed

- Failure to file: 8% of all penalties assessed

- Accuracy penalty: Less than 2% of all penalties assessed

IRS Assessed Penalties: 2018 to individual taxpayers

IRS Assessed Penalties: 2018 to individual taxpayers

Some penalties are costlierthan others

Out of the four most common penalties, the IRS assesses themost expensive penalties on the taxpayers who do not file on time or who fileinaccurate returns. These two penaltiesare the costliest to taxpayers:

- Accuracy:for most taxpayers, the accuracy penalty assesses an additional 20% to the taxbill. Taxpayers get many of these penaltiesfrom matching notices (CP2000s) and audits. If the IRS determines that fraud is involved, the penalty rises to75%. In 2018, the average accuracypenalty assessed was negligence or substantial understatement (20% penalty) was$1,935. If fraud was involved, theaverage penalty assessed was $61,692.

- Failureto file: the failure to filepenalty is 5% per month, up to 25% and applies only if you owe. This penalty can add up quick: the average FTF penalty in 2018 was $1,196.

Underpaymentpenalties: failure to pay and estimatedtax

The failure to pay and estimated tax penalties are the trickiestto compute.

The failure to pay penalties is 0.5% per month, up to25%. However, if a taxpayer also has theFTF penalty in addition to FTP, the total of the FTF and FTP penalties cannotexceed 47.5%. To confuse the taxpayermore, the FTP penalty can fluctuate depending on your status with the IRS. If the IRS is pursuing collection on ataxpayer’s unpaid balance, the FTP penalty rises to 1% per month. If the taxpayer is in an installmentagreement to pay the IRS, the taxpayer is rewarded with a reduced FTP penaltyof 0.25% per month. The average FTPpenalty assessed in 2018 was $288.

The estimated tax penalty is becoming much more common thesedays as more workers set out on their own in the gig economy. The estimated tax penalty represents thelost time value of money to the taxpayer for not having enough withholding orestimated tax payments made throughout the year. Basically, the estimated taxpenalty is the lost interest to the IRS for not paying your taxes ratably throughoutthe year as income is received. Currently,the interest rate is 6%on underpayments. The average estimatedtax penalty assessed in 2018 was $157.

Abatements ofpenalties are not common

To get relief from the failure to pay or file penalties,taxpayers must request abatement. However,few actually do. Only 11% of allpenalties assessed were abated in 2018. Taxpayerswith the failure to file or pay penalty are likely still not requesting first-timeor reasonablecause abatement.

Taxpayer facing the accuracy penalty must request that itnot be asserted during an audit or a CP2000. Abatement is only available if the taxpayer requests the audit or CP2000to be reconsidered or follow IRS claim for refund procedures. It is always best to argue the penalty withthe IRS during the audit or CP2000 proceeding. Only 8% of accuracy penalties were abated in 2018.

Relief from the estimated tax penalty is requested when ataxpayer files a tax return. The taxpayercan use Form 2210, Underpayment of Estimated Tax byIndividuals, Estates, and Trusts, torequest an exception to the penalty. For2018 returns, the IRS has allowed morerelief for the estimated tax penalty due to tax reform confusion. The IRS also Less than 1% of all estimatedtax penalties are abated – the Form 2210 is the way to go.

When in doubt, askfor relief

Penalty abatement can get complicated- the IRS devotes anentire section of its Internal Revenue Manual to penalties. Taxpayers who believe they may qualify needto understand the reasons and the procedures for abatement. Theworse thing a taxpayer can do is not to ask. It is notlikely that the IRS reaches out to you and provide relief- the only way toobtain relief is to request it.

Keep researching, or ask us for help…

Need more information about IRS tax issues? We have you covered. Choose the option below that’s best for you.