About 18% of all IRS payment plans default each year. That amounts to about 1 million taxpayers a year who get into hot water because their IRS payment plan has been terminated for noncompliance. For those who default on an IRS payment plan or “installment agreement,” there are a few options to get back in good standing with the IRS and avoid enforced collection activity (liens and levies).

What causes default?

There are four reasons the IRS defaults installment agreements and requires the taxpayer to make a new agreement or pay the tax to avoid enforced collection:

- Missed payments: you missed two payments in a year (for most IRS payment plans, the IRS allows you to miss one a year without default)

- Another balance owed: you file another return or have another balance owed (like from an audit or CP2000 assessment) and do not pay the balance in full (including penalties and interest)

- Non-responsive to IRS: the IRS asks you to provide updated financial information and you do not provide the information or provide incomplete information, or

- Did not adjust payments: you fail to pay a modified payment amount that you agreed to with the IRS

Two important items

First, the IRS does not allow more than one collection arrangement per taxpayer. For example, if you are in an installment agreement for a year and you file and owe on the next year, the IRS will not give you a separate payment plan on the new return balance owed. You can only have one agreement with the IRS and it must cover all balances owed.

Second, if you have an Affordable Care Act (ACA or Obamacare) individual shared responsibility payment liability (ISRP) for not having adequate healthcare coverage and it generates an amount owed to the IRS, it will not, in itself, default the installment agreement. The IRS cannot enforce collection on ACA penalties. Payment has to be made through an installment agreement or from future refunds.

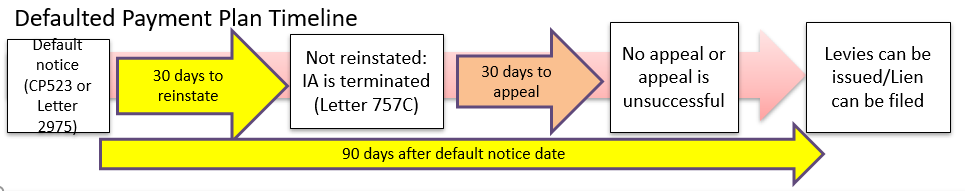

Default timeline and reinstatement

When you miss a payment, file another balance due return without payment, or fail to comply with the terms of the payment plan, the IRS ultimately sends you one of two notices: CP523 or Letter 2975. These notices do not terminate your agreement – but they do put you on notice that you have 30 days to take action, or the agreement will be terminated. The IRS will not issue a levy until 90 days after the CP523/Letter 2975 date.

Within the next 30 days after the CP523 notice, you can reinstate the installment agreement to avoid IRS levies. However, the IRS has the discretion to request new financial information depending on your circumstances to reinstate the agreement. Routinely, the IRS allows two circumstances to automatically reinstate the payment plan:

- The agreement defaulted because of a new tax liability and the new amount would be paid in two additional monthly payments, or

- The taxpayer would qualify for a streamlined installment agreement (owe less than $50,000 and can pay within 72 months) AND the taxpayer has not defaulted on an installment agreement in the past 12 months.

In both circumstances, the IRS reserves the right to file a federal tax lien. However, in practice, the IRS rarely files a lien (assuming one is not already filed) if the taxpayer owes under $10,000 or qualifies and obtains a streamlined installment agreement.

Starting from scratch

If you do not qualify for the automatic criteria for reinstatement, the IRS will want financial information. In some cases, you may be able to provide limited financial information over the phone (usually employer and bank information) if you can pay on the streamlined installment agreement terms. But if you cannot pay the streamlined terms or owe over $50,000, the IRS will want more detailed financial information. Taxpayers with over $50,000 owed will likely result in a filing of a federal tax lien and a payment plan based on their ability to pay.

If the taxpayer defaulted because of a new balance owed from a recently filed return, the IRS will also want the taxpayer to increase their withholding and/or make estimated tax payments if underwitholding was the cause for the new balance.

The cost of doing nothing

If a taxpayer does not get back into good standing with the IRS within 90 days, they may face enforced IRS collection. If a lien had not been filed, the taxpayer is likely to see a tax lien filing if they owe more than $10,000. The IRS will also look to employers, financial institutions, and other payers for payment in the form of a levy. If you owe more than $53,000 (for tax year 2020 – this amount is adjusted annually for inflation), the IRS will likely start passport restriction proceedings with the State Department.

In most cases, it is practical to get into a streamlined installment agreement. If you reassure the IRS that you will not owe again and agree to direct debit payments, they often allow you to reinstate your agreement – and the only cost to you is the reinstatement fee of $89.

Keep researching, or ask us for help…

Need more information about IRS tax issues? We have you covered. Choose the option below that’s best for you.